Key Points

- President Trump’s tariffs have led to a surge in revenue for the government, but also a record-breaking financial shortfall among importers required to buy special bonds to guarantee payment of trade duties.

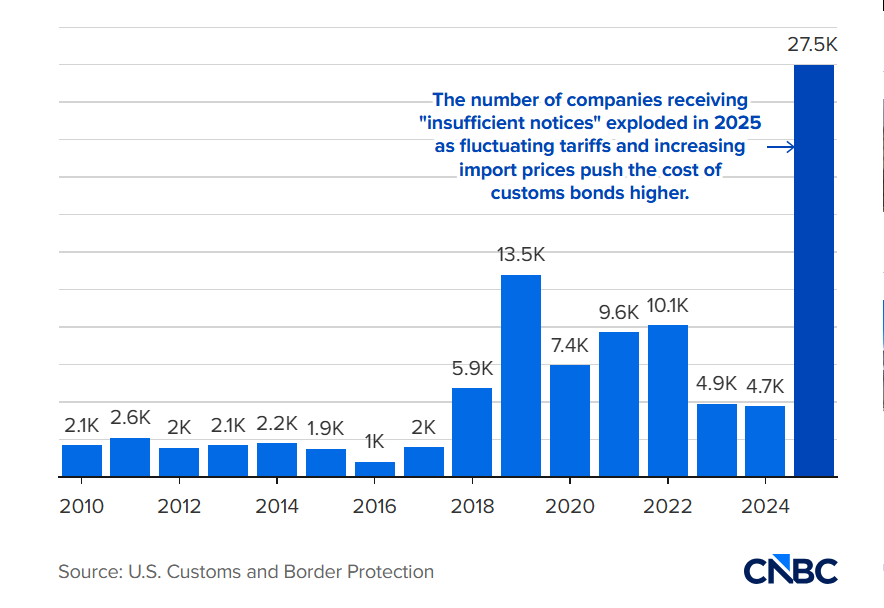

- U.S. Customs and Border Protection tells CNBC that for fiscal 2025 it has identified 27,479 customs bond “insufficiencies” valued at nearly $3.6 billion, double the 2019 level when insufficiencies first soared due to Trump’s first-term trade policies.

- Importers are unable to receive their freight if their customs bonds, issued by insurers, are not sufficiently funded.

A record-breaking number of companies shipping products into the United States are coming up short on a federal government requirement to financially guarantee they can cover the import trade duties triggered by President Donald Trump’s tariff policies.

And this is leading to a record amount of money paid to the U.S. to cover the shortfalls.

U.S. Customs and Border Protection data shared with CNBC shows that what are called customs bond “insufficiencies” reached a total of 27,479 in fiscal 2025, with the combined value soaring to almost $3.6 billion. It is the highest number of bond insufficiencies and the highest total value across insufficiencies ever recorded. In fact, it doubles the 2019 level when tariffs enacted by Trump under Section 301 of the Trade Act of 1974 also fueled bond shortfalls.

“Bonds are the primary tool used by U.S. Customs and Border Protection to safeguard the revenue of the United States and ensure compliance with applicable laws and regulations,” said a U.S. Customs and Border Protection spokesperson.

Customs bond insufficiencies

Total notices | 2010–2025

Under CBP guidelines, the agency continuously reviews bond adequacy, and a bond is flagged as being insufficient when an importer’s duty/tax liability exceeds 100% of their current bond capacity. The shortfall comes at a time of record tariff revenue for the U.S. government, with tariff collections surging in January to $30 billion and reaching a year-to-date total of $124 billion. That is up 304% from the same period in 2025.

“In totality, it makes sense that insufficiencies are more than double,” said Jennifer Diaz, attorney at Diaz Trade Law. “Many companies take it for granted that a $50,000 bond should be able to cover you for a one-year period,” she said. “But it might not. They are not utilizing set calculations, and don’t have anyone in their corner telling them that their bond obligation is higher.”

International trade experts told CNBC that with some tariffs increasing from 10%-25% or more for certain products, importers are facing customs bond amounts that now range from the minimum bond amount by regulation of $50,000 to as high as $450 million.

Importers buy customs bonds, also known as surety bonds, through specialized insurance companies known as surety companies. The bonds are issued approximately 30 days before imports arrive in the U.S. to ensure that Customs collects the requisite tariffs in the event an importer does not pay its obligation. The bonds are held for 314 days by CBP in accounts that bear no interest. During this time, duties that were paid can be reviewed and receive final government sign-off.

U.S. importers pay a premium to insure their bonds. The premium is typically 1% of the bond limit, with the price of the bonds covering 10% of the duties and taxes paid over a rolling 12-month period. If tariffs and taxes go up, the customs bond requirement goes up as well.

Surety companies have told CNBC they have seen bond increases upward of 200%. “In one unusual case, a large auto manufacturing client saw its custom bond amount increase by 550%,” Vincent Moy, international surety leader for Marsh Risk, recently told CNBC.

If the bond is insufficient, the importer can’t get the freight, and it is held by CBP until the bond meets requirements. To address the shortfall, importers need to have another bond issued and that can take at least 10 days.

In addition to the bonds, companies rely on related collateral to guarantee trade duty coverage. “If companies do not increase their collateral, the goods will be stopped at the port,” Moy said. The collateral is held by the insurance company that issues the bond for the 314-day period dictated by CBP. Companies have told CNBC that the tariff-triggered bond insufficiencies have created additional strain on their relationships with customs brokers.

The Supreme Court could soon rule on Trump’s International Emergency Economic Powers Act tariffs, deciding if they are legal. Feb. 20 is the next date for a potential decision and U.S. importers may be in line for not only trade tax refunds but also the money laid out for customs bonds and related collateral. If tariffs are refunded, the bond amounts associated with those imports can be used to reduce to levels sufficient to cover the duties, taxes and fees. Companies will need to petition the insurer that issued the bond for a reduction of the bond and collateral. Trade experts tell CNBC importers should be ready if this happens.

Surety companies tell CNBC importers should expect some lag time in receiving these funds due to insurance paperwork requirements. The insurance company will need to verify and audit the paper trail before it releases any collateral.

Source: www.cnbc.com