How Ghana Has Spent Its Oil Wealth Since 2011 — Fourteen Years OnFourteen years after the first barrels of oil flowed from the Jubilee Field, Ghana’s petroleum story remains one of promise and underwhelming returns.

Despite earning an estimated $11.58 billion from crude production since 2011, the sweeping transformation many anticipated has yet to materialize.The country’s share of oil proceeds comes from a combination of royalties (5–12.5%), surface rentals ($30–$100 per km²), a 15% carried interest, 35% corporate income tax, and other negotiated payments specific to each operator.

Government revenues from oil peaked in 2022 at $1.43 billion, but have since been on a downward trend, reflecting both declining production and macroeconomic pressures. In the first half of 2025, oil receipts dropped to $370 million, less than half of the $840 million collected during the same period in 2024.

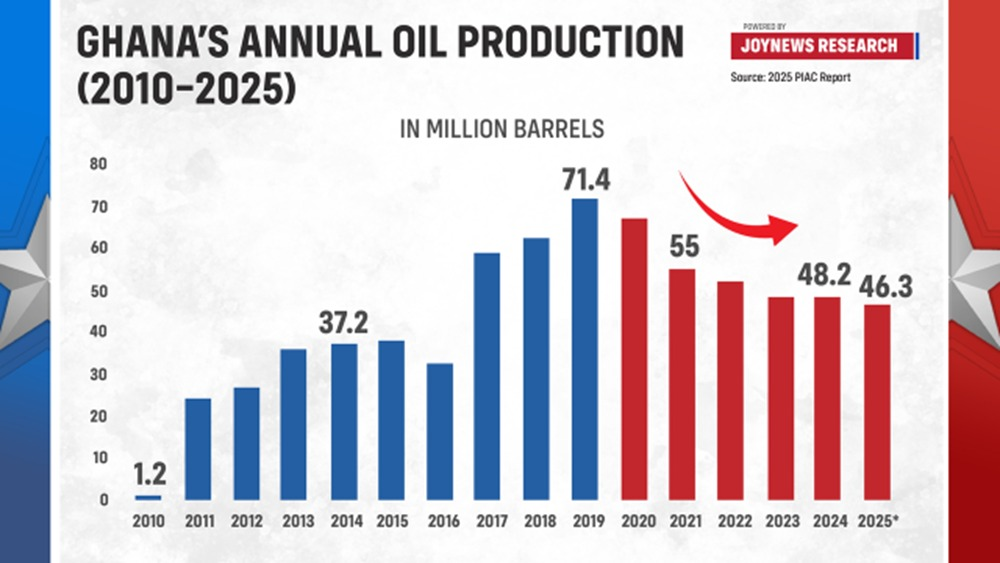

A strengthening cedi further eroded the dollar value of these inflows.Since production began, Ghana has extracted roughly 675 million barrels of crude. The central question now is not whether the country has gained from oil, but how effectively that income has been used.

How Ghana Has Spent Its Oil Wealth Since 2011 — Fourteen Years On

Fourteen years after the first barrels of oil flowed from the Jubilee Field, Ghana’s petroleum story remains one of promise and underwhelming returns. Despite earning an estimated $11.58 billion from crude production since 2011, the sweeping transformation many anticipated has yet to materialize.

The country’s share of oil proceeds comes from a combination of royalties (5–12.5%), surface rentals ($30–$100 per km²), a 15% carried interest, 35% corporate income tax, and other negotiated payments specific to each operator.

Government revenues from oil peaked in 2022 at $1.43 billion, but have since been on a downward trend, reflecting both declining production and macroeconomic pressures. In the first half of 2025, oil receipts dropped to $370 million, less than half of the $840 million collected during the same period in 2024.

A strengthening cedi further eroded the dollar value of these inflows.

Since production began, Ghana has extracted roughly 675 million barrels of crude. The central question now is not whether the country has gained from oil, but how effectively that income has been used.

Tracking the Oil Money

Speaking under the Africa Extractives Media Fellowship (AEMF)—an initiative led by Newswire Africa and the Australian High Commission—Isaac Dwamena, Coordinator of the Public Interest and Accountability Committee (PIAC), outlined how petroleum revenues have been distributed under the Petroleum Revenue Management Act (PRMA).

All oil-related earnings are deposited into the Petroleum Holding Fund (PHF) before being allocated to key entities:

• Ghana National Petroleum Corporation (GNPC): about $3.15 billion for exploration and operations.

• Ghana Stabilisation Fund: around $2.6 billion to cushion the budget against oil price volatility.

• Ghana Heritage Fund: roughly $1.1 billion saved for future generations, now holding about $1.3 billion in assets.

• Annual Budget Funding Amount (ABFA): approximately $4.5 billion channeled into the national budget.

The ABFA remains the most visible conduit for oil-funded projects, financing initiatives that directly touch citizens’ lives. Its funds have supported Kotoka International Airport’s Terminal 3, the Kojokrom–Tarkwa railway, the Axim coastal protection project, the Tamne irrigation scheme, Free Senior High School, and the Atuabo gas processing plant, among others.

Big Projects, Limited Transformation

While these investments are tangible, many Ghanaians continue to question whether oil wealth has meaningfully improved living standards.

Mr. Dwamena attributes the uneven outcomes to the absence of a long-term national development plan formally approved by Parliament.

Without such a roadmap, he said, petroleum funds have been dispersed across multiple short-term projects, diluting their impact and contributing to cost overruns and implementation delays.

The 2025 national budget marks a shift in approach. The government has decided to dedicate 95% of ABFA allocations to its Big Push infrastructure initiative, aimed at accelerating major road construction nationwide. The remaining 5% will go to the District Assemblies Common Fund.

This change departs sharply from past practice, which spread oil revenue across several sectors, and represents a more concentrated—if riskier—attempt to drive visible progress.

Lessons and the Road Ahead

Ghana’s experience stands in contrast to Norway, whose petroleum wealth is managed through a massive sovereign wealth fund that invests almost entirely abroad, limiting withdrawals to safeguard long-term value.

Ghana’s own oil revenue management framework, crafted over a decade ago, may now need review. As the global energy transition accelerates and domestic production declines, experts say the country must reassess how its petroleum funds are invested and governed. Public consultations, expert reviews, and parliamentary debate could help refresh the rules to reflect new fiscal realities and ensure oil wealth continues to serve future generations.

For now, Ghana’s oil money has built airports, schools, railways, and pipelines—a legacy that is visible, yet incomplete. What remains elusive is the deeper economic transformation that was promised when oil first began to flow in 2011.

Source: ernergycrossroad.com